The Skinny

Some of American Express cards earn rewards as Membership Rewards

Membership Rewards programs are different in each country

In the Canadian program, the best uses of Membership Rewards are:

- British Airways Avios

- Aeroplan

- Statement credit at a rate of 1 Membership Rewards = 1 ¢

My value of a Membership Reward in Canada is greater than 1.5 ¢

Overview

American Express is one of the few large credit card issuers in Canada. They offer cards with their own rewards program called Membership Rewards. In this article, Ill go through the best ways to redeem your Membership Rewards for good value.

The main takeaway from this article should be that you should only earn Membership Rewards with the intention of transferring them to British Airways Avios or Aeroplan miles. If you are earning them for other uses, including cash back, or pay with points, you are likely going to do better with a different credit card solution, than Membership Rewards in Canada.

That being said, if you must use an American Express card that earns Membership Rewards or earns nothing at all, then obviously you should earn the Membership Rewards.

Accessing Membership Rewards

The Membership Rewards site is easily accessible online when logged into your credit card account. You will need to be logged in to view it this way.

Alternatively, you can navigate to www.membershiprewards.ca and use your American Express login information to access the site.

What Are Membership Rewards

Membership Rewards are a currency that can transfer to different airline partners or be redeemed for statement credits and other cash equivalents. Getting the most value out of these will require a certain amount of effort.

Earning

Rewards are earned when using certain American Express branded credit cards. The American Express Premier Gold Rewards card, for example, earns 2 Membership Rewards per dollar spent on gas, grocery, drug store and travel purchases, and 1 Membership Reward per dollar spent.

Cards which earn Membership Rewards in Canada

Personal Cards:

Business Cards:

- The Business Platinum Card from American Express

- American Express® Business Gold Rewards Card

Redeeming

Membership Rewards are an interesting beast. Ill go through some of the nuances.

Membership Rewards differ by country

First of all, Membership Rewards differ by country. Here at Creditwalk, we focus on Canadian cards, and will focus on the Canadian program. The reason I mention the US program is because any research you might do may encounter information on the US program that will differ from the Canadian program.

Different Partners by Country

There are different partners with each program. For example, ANA rewards, which I showed how to exploit for amazing value here, are only a transfer partner of Membership Rewards US.

Transfer Rates Differ By Country

Secondly, Membership Rewards transfer rates differ between country. For example, with the Starwood Preferred guest program, transfer from Membership Rewards USA transfer at a rate of 3 Membership Rewards to 1 Starwood Preferred Guest point. In Canada, it only takes 2 Membership Rewards to get 1 Starwood Guest point.

| Uses | Return For 1000 Canadian Membership Rewards | Return for 1000 US Membership Rewards |

|---|---|---|

| British Airways Avios | 1000 Avios | 1000 Avios |

| Aeroplan | 1000 Aeroplan | 1000 Aeroplan |

| Delta Skymiles | 750 Delta | 1000 Delta |

| Hilton HHonors | 1000 Hilton HHonors | 1500 Hilton HHonors |

| SPG | 500 SPG Points | 333 SPG Points |

| Alitalia | 750 Alitalia | – |

| Asia Miles | 750 Asia Miles | – |

| Etihad | 750 Etihad | – |

| ANA | 1000 ANA | |

| Aeromexico | – | 1000 Aeromoexico |

| Air France | – | 1000 Air France |

| El Al | – | 1000 El Al |

| Emirates | – | 1000 Skywards Miles |

| Frontier | – | 1000 Frontier |

| Hawaiian | – | 1000 Hawaiian |

| Iberia | – | 1000 Iberia Avios |

| Jetblue | – | 800 JetBlue |

| Singapore Aire | – | 1000 Singapore |

| Virgin America | – | 500 Virgin Elevate |

| Virgin Atlantic | – | 1000 Virgin Miles |

| Best Western | – | 1000 Best Western |

| Choice Privileges | – | 1000 Choice Points |

Different Promotions by Country

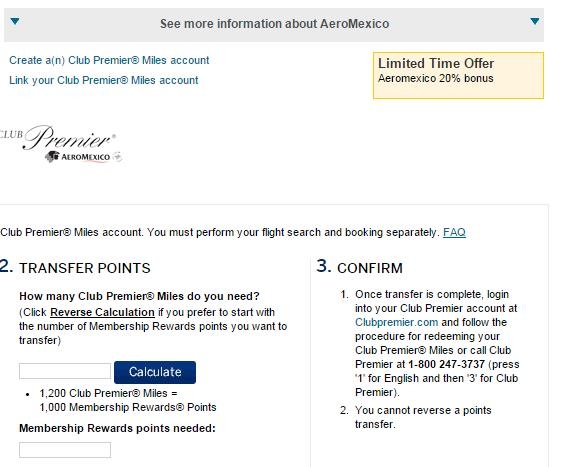

Thirdly, there are often different promotions on transfers to various partners. For example, it is often the case that Membership Rewards USA transfer to British Airways Avios at a rate of 1:1 with a transfer bonus of 40%. I have never seen this in the Canadian Membership Rewards program. In early 2015, there is a 20% bonus for transfers to Aeromexico from the US Membership Rewards program.

Redemption Options – Canada

There are many redemption options for Membership Rewards in Canada including:

- Transferring to frequent flyer programs

- Paying for travel (either as point of purchase or as reimbursement via statement credit)

- Gift Cards

- Buying various goods

| Uses | Return for 1000 MR | My Valuation | Return for 1000 MR | Comments |

|---|---|---|---|---|

| British Airways Avios | 1000 Avios | 1.5 | $15.00 | Good use |

| Aeroplan | 1000 Aeroplan | 1.25 | $12.50 | Good use |

| American Express Travel (Pay with Points) | $10 Discount on a Trip | $10.00 | ||

| TripFlex Rewards | $10 statement credit against a travel charge | $10.00 | Use if you have no use for Avios or Aeroplan miles | |

| Delta Skymiles | 750 Delta | 1.1 | $8.25 | Only when you can get great value from Delta miles |

| Alitalia | 750 Alitalia | 1 | $7.50 | |

| Asia Miles | 750 Asia Miles | 1 | $7.50 | |

| Etihad | 750 Etihad | 1 | $7.50 | |

| Hilton Hhonors | 1000 Hilton | 0.4 | $4.00 | |

| Starwood Preferred Guest | 500 SPG | 1.875 | $9.38 | |

| Ticketmaster Gift Certificate | $7 Ticketmaster Gift Certificate | $7.00 | ||

| Goods | Well below $5 of value | $4.08 |

Baseline – Cash-Equivalents at $0.01 / Membership Reward

When trying to evaluate Membership Rewards, it is important to assess which redemptions have an exact and flexible value and set the minimum level for these. In this case, the “travel” options are essentially cash and allow you to always get 1¢ for each Membership Reward.

TripFlex Rewards

Tripflex Rewards is Memvership Rewards way of giving you a statement credit out of your Membership Rewards. Basically, buy your travel any way that you like and then once it shows up on your statement, request to pay it back using your Membership Rewards. Membership Rewards can be used at a rate of 1 Membership Rewards = $0.01 statement credit against a travel charge, with a $10 minimum.

There are many things that will constitute a travel charge, including air, hotel, car rental, many bus fare, many taxis etc. You have the ability to shop around as you wish and buy the trip you want. Since this is so easy, I consider this as close to cashback as possible with Membership Rewards. You even earn more Membership Rewards on the purchase.

I think this method should be set as the baseline for comparing the values of other options.

American Express Travel / Pay With Points

This is closely related to the TripFlex option, except it allows you to “pay with points” at the same rate. If you are shopping for a flight on travel.americanexpress.ca, you can simply use your points as the currency and the charge wont show up on your statement. I think it is almost the same thing, except the Pay With Points option means you don’t earn additional Membership Rewards on the purchase on your credit card.

Transfers to Frequent Flyer Programs

My favorites

There are a multitude of frequent flyer transfer options. The main ones that are advertised, and the ones that I believe offer the best value are as follows:

- Transfer to British Airways Avios

- Transfer to Air Canada Aeroplan

British Airways Avios

Membership Rewards transfer to Avios at a rate of 1000 Membership Rewards = 1000 British Airways Avios. Avios provide the best value for Canadians who travel to the US on short flights. The best values come for redeeming on American Airlines / US Airways or Alaska Airlines. I give a good overview of finding availability in my answer to a question on traveling between Vancouver and Portland here. Note that you can’t redeem Avios for flights wholly within Canada.

My personal valuation of British Airways Avios is 1.5 ¢ each.

Air Canada Aeroplan

Membership Rewards transfer to Aeroplan at a rate of 1000 Membership Rewards = 1000 Aeroplan miles. Aeroplan provide decent value for certain routes. If you are able to travel to the US and redeem for flights on United Airlines or use them for overseas flights on certain airlines (Air Canada is not a good airline to redeem Aeroplan miles on if you can help it), then you can get great value from them. My recent series Is Aeroplan the Best Plan? discusses when and where Aeroplan provides value and whether those are the best uses. When traveling wholly within Canada, most cross country routes are quite expensive (Vancouver – Toronto will be double the rate of a comparable Seattle – Buffalo or a Los Angeles – New York flight) thus Aeroplan miles sometimes provide good value on these routes.

For further reading on Aeroplan miles vs British Airways Avios, see Aeroplan Short Haul – Good Deal or Sucker’s Bet.

My personal valuation of Aeroplan miles is 1.25 ¢ each.

Delta Skymiles

Membership Rewards transfer to Delta at a rate of 1000 Membership Rewards = 1000 Delta Skymiles. Delta used to have great value, but recent changes have changed their value.

Primarily, there is no award chart available to view the redemption rates so it is very difficult to do analysis on this. Secondly, it appears that stopovers are no longer allowed on Skymiles award flights. It used to be that stopovers in Delta hubs were allowed, which created opportunities for Canadians in Windsor (using Detroit airport) and Vancouver / Victoria (using Seattle airport) to tack on free flights onto award flights. Finally, Delta Skymiles award tickets have always been tougher to find space for than the others.

I believe this would be a poor use of Membership Rewards. If you are intending on earning Membership Rewards with the intention of earning Skymiles, the Capital One Delta Skymiles card will serve you much much better.

Other Frequent Flyer Programs

The other frequent flyer programs all tend to provide poor value in my opinion. All the programs of Alitalia, Asia Miles, Etihad and Delta each transfer at a lesser rate than both Aeroplan or British Airways Avios. For these programs, 1000 Membership Rewards = 750 Miles. Personally, I don’t find great value in these programs, especially as a Canadian.

Hilton Hhonors

The Hilton Hhonors program is one of 2 hotel programs available to transfer Membership Rewards into. In this case, 1000 Membership Rewards transfer to 1000 Hilton Hhonors, implying that a Hilton Hhonors point is worth something in the same magnitude as an Avios, or Aeroplan. This is far from the case.

In general, Hilton HHonors points are generally worth less than ½¢ each. My personal valuation is 0.4¢ each.

If you are interested in transferring your Membership Rewards to Hilton HHonors points, consider that you can always just book the hotel using your credit card, paying any rate you can find, and Membership Rewards will be able to reimburse you at a rate of 1000 Membership Reward = $10 statement credit toward travel. I imagine you would be hard pressed to get even close to $0.01 of value from each Hilton HHonors point even when compared against the rack rate.

Starwood Preferred Guest

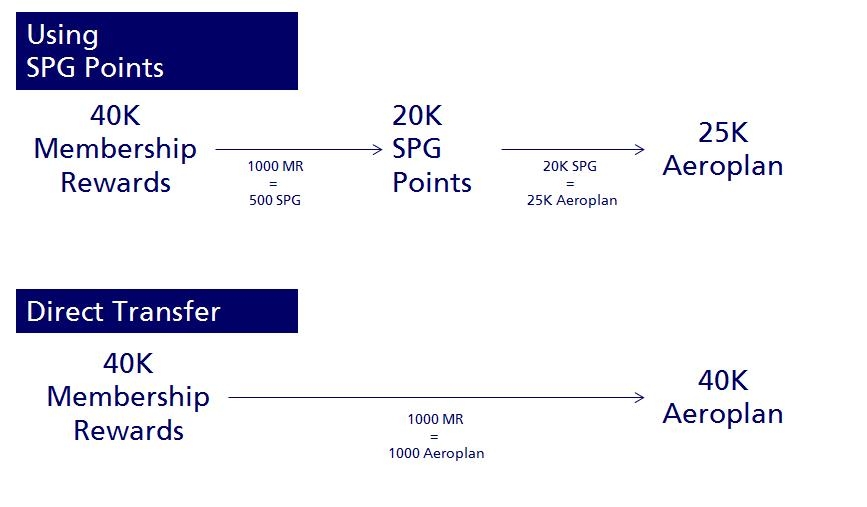

The Starwood Preferred Guest (SPG) program is one of the best loyalty programs out there and has tremendous value. As a result, the transfer ratio reflects this as 1000 Membership Rewards = 500 SPG points.

Given this 2:1 transfer ratio, that would imply that an SPG point is worth double an Aeroplan or British Airways Avios. SPG points transfer to pretty much any airline loyalty program so if you are looking to top up say American miles, then SPG points are infinitely more valuable than the other 2. SPG points also transfer with a bonus to most other airline programs with a 25% bonus.

Unfortunately, the ratio is just too expensive, in my opinion. If you are looking to earn SPG points, American Express has a few cards which will earn you more SPG points directly than if you wanted to transfer from Membership Rewards.

Gift Certificates

Membership Rewards also claim to be able to buy gift certificates. At the time of this writing, the only gift certificates are TicketMaster gift certificates, which cost 2000 Membership Rewards for $14 gift certificate. That is a very poor value for gift certificates, assuming that 2000 Membership Rewards could easily be traded for a $20 statement credit against travel. If you are interested in buying gift certificates, you would be better off buying the gift certificate from a travel provider and then redeeming your Membership Rewards as a statement credit against that travel charge. Think hotels here.

In general, the gift certificates from these programs tend to provide poor value.

Goods

Membership Rewards is not in the business of buying and selling items. They are a loyalty program, and as a result they are not going to be “efficient” about buying you things that you can get from Walmart and The Bay. As a result, all that extra overhead and expense associate with getting you a product gets passed on to you in the form of a higher price. In fact, some of the prices are so bad, that I actually thought some of them were a pretty good deal, until I realized I was off by a factor of 10!

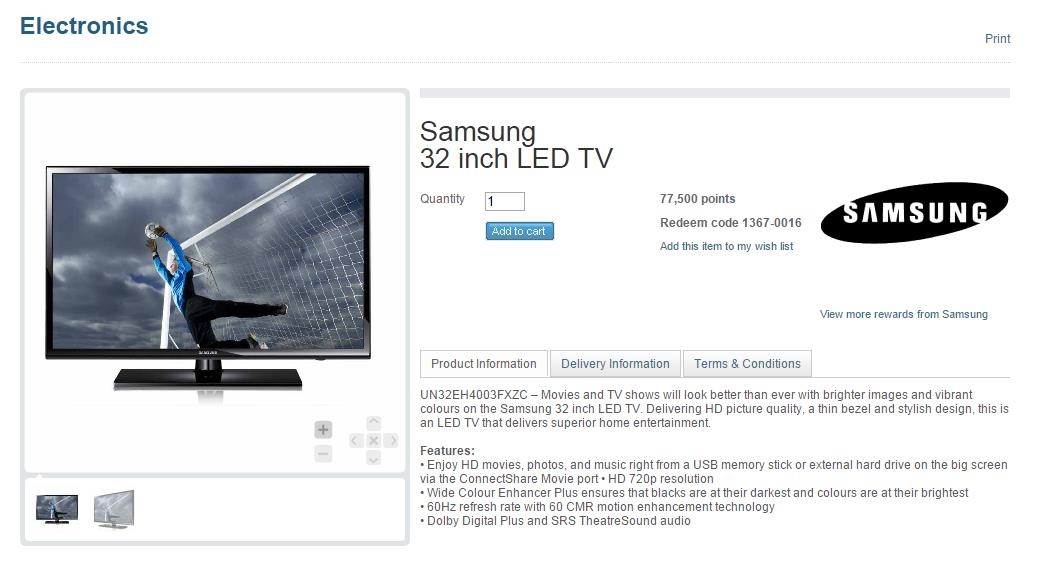

Let’s take an example:

This Samsung 32 Inch LED TV is selling for 77,500 Membership Rewards. Off the top of my head, I know that I can get $775 of travel purchases for those Membership Rewards points. I don’t think that a 32 Inch TV is worth $775 in 2015.

For further comparison, this model sells for $279.99 + tax at Bestbuy.ca.

Assuming there is no tax on the Membership Rewards redemption that gives a return of 0.4 ¢ / Membership Reward, which is awful.

I strongly suggest avoiding this route.

Summary

The Membership Rewards program in Canada can be valuable. If you have a card that earns you Membership Rewards, then there are really 3 options that give you good value. All other options tend to provide very poor value in relation.

- British Arways Avios

- Aeroplan

- Statement credit at 1 Memberhship Reward = 1¢

When doing research, make sure you are looking at the Canadian program as the rates and partners differ by country.

One comment on “Earning, Redeeming & Transferring American Express Membership Rewards in Canada”