This is an article in a series on finding the best travel credit cards for travel to Europe from Victoria.

Related Articles:

- Best Travel Credit Card – Factors to Consider

- Best Travel Credit Card – Rewards Programs

- Best Travel Credit Card – The Credit Cards

The Skinny

There are a few credit cards that will get you the miles and points that you need to get to Europe. Each will have different spending requirements based on the earning levels and how many points needed to get to Europe, during the off-peak time.

For the specific situation, I suggest getting a travel card that earns travel dollars or the Delta Skymiles credit card. The specific card would definitely depend on the the specific factors.

- Scotiabank Gold Application Link

- Capital One Aspire World Application Link

- Capital One Delta Skymiles Application Link

Review

Randy wants a credit card suggestion:

I’m wondering if you can recommend a credit card for my situation.

Based in Victoria, I want to fly my family to Europe in about 2 years from now. 2 adults, 3 kids. We put about $60k a year on our credit card, and will be doing a house reno. So I can probably do about $150k to $200k in the next 2 years.

We don’t care where in continental Europe we fly to, or what airline. We’ll probably fly during the off season.

-Randy

In the previous 2 articles, I noted the factors that Randy should consider when making his decision, followed by how much it would cost him in terms of miles through each program. In this article, I’ll show Randy what credit cards he can choose from, in an effort to acquire the currency.

Objective

I will base my recommendation to Randy on which card (or group of cards) will get Randy and his family over to Europe with the least amount of spending required.

Recap of miles required

Let’s recap how many miles Randy would need to get the flights that he is interested in taking. Now, Randy has a wife and 3 children, so will require 5 tickets. Here is how many miles he will need.

- Scotiabank Gold

- Capital One Aspire World

| Amount of Currency (1 passenger) |

Approximate taxes and fees (1 passenger |

Amount of Currency (5 passengers) |

Approximate taxes and fees (5 passengers) |

Suggested Credit Card(s)(only the best) | |

|---|---|---|---|---|---|

| Air Canada Aeroplan | 60K | $175 | 300K | $875 |

|

| Air Miles | 5118 | 25590 |

|

||

| American Airlines AAdvantage | 40K | $156 | 200K | $780 |

|

| British Airways Avios | 74.5K | $156 | 372.5K | $780 |

|

| Delta Skymiles | 60K | $153 | 300K | $765 |

|

| US Airways Dividend Miles | 35K | $143 | 175K | $715 |

|

| Cash (Revenue Ticket) | $1000 | (included) | $5000 | (included) |

My Recommendation

Based on all of Randy’s factors, mainly the fact that there are 5 people who will likely want to travel on the same flight, combined with the fact that Randy probably will not want the risk of a very complicated routing, I would suggest looking at booking revenue tickets for this trip.

First Suggestion

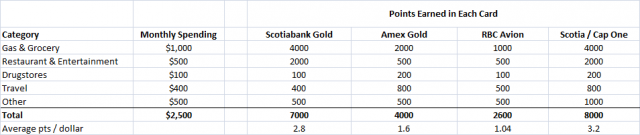

The combination of the following 2 cards will earn him money in his travel bank that he can use to pay for the flights he wants. He should get the Scotiabank Gold card for all his spending in the gas, grocery, restaurant & entertainment categories, and the Capital One Aspire World card for everything else. Based on my assumptions about his regular monthly spending (not including his home renovations), he should average about 3.2% return on his spending.

| Card | Type | Categories | Return in Categories |

|---|---|---|---|

| Scotiabank Gold Card | American Express | Gas, grocery, restaurant & entertainment | 4% |

| Capital One Aspire World | Mastercard | Everything else | 2% |

Second Suggestion

A very close second for Randy would be to get the Delta Skymiles card. If Randy were interested in flying in groups of 2 or maybe even 3, I would say this card could be a better deal for him. The ability to get 1.5 trips (the free extra one-way flight on the back end) is very valuable and his spending requirement would be less using this card. Ultimately Randy has to decide whether he wants to risk having miles that might not be able to get him 5 seats on the same flight when he is interested in flying.

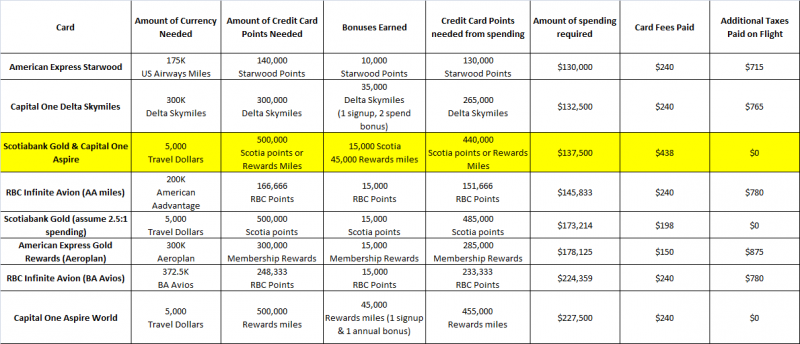

Randy’s Spend Required by Card

In an effort to help Randy decide which card to choose, it makes the most sense to find out how much he needs to spend on any given card to earn the trip he wants to take.

There are a few things to consider, including factoring in any signup bonuses and annual fees that may be paid. For this purpose, I’ll assume he will get 1 sign up bonus (Mrs. Randy will not apply for a card for the bonus) and he will keep the card for 2 years (paying 2 annual fees).

Here are the assumptions that I made on Randy’s spending habits each month.

Specific Cards

Scotiabank American Express Gold

| Type: | American Express |

| Rewards: | 4 pts / dollar on gas, grocery, restaurant & entertainment 1 pt / dollar on everything else |

| Annual Fee: | $99 |

| Sign-up Bonus: | 15,000 pts ($150) |

| Point Value: | 1 pt = $0.01 towards travel (no restrictions) |

The Scotiabank Gold card is my favorite card for most people who have most of their credit card spending on “living life”. Most of the expenses of a family, or young professional tend to come under gas, grocery and restaurant, which all earn 4 pts (or 4% towards travel).

- See my full review of the Scotiabank Gold American Express Card

Given that I assume most of Randy’s spending will be in these privileged categories, I would suggest he use this card for all spending in those categories. When lined up against a card earning 1 mile / dollar, Randy would be essentially “buying” miles for 4 cents each when spending in the gas, grocery and restaurant category.

The only issue with this card is that it is an American Express card. Randy will have to see whether or not his favorite retailers accept American Express cards.

Capital One Aspire World

Capital One Aspire World Application Link

| Type: | Mastercard |

| Rewards: | 2 pts / dollar on everything |

| Annual Fee: | $120 |

| Annual Bonus: | 10,000 pts (~$100) |

| Sign-up Bonus: | 35,000 pts (~$350) |

| Point Value: | 1 pt = $0.01 towards travel (within various restrictive tiers) |

The Capital One Aspire World card earns 2 pts / dollar on every purchase, which is great for those times when the purchase is not in a bonus category. This card is also a Mastercard so it should be accepted pretty much everywhere credit cards are accepted.

The issue with this card is that the redemption of points are only favorable if they are redeemed for travel at the appropriate tiers. Anything above $600 of points redeemed gets you a value of $0.01 / pt. Since Randy wants to redeem his points for flights to Europe which cost more than $600 each, he should have no problem getting the best value, making this a 2% card for him.

RBC Infinite Avion

RBC Infinite Avion Application Link

| Type: | Visa |

| Rewards: | 1.25 pts / dollar on travel related purchases 1 pts / dollar on everything else |

| Annual Fee: | $120 |

| Sign-up Bonus: | 15,000 pts |

| Point Value: | 1 pt transfers to various programs 1 RBC = 1.2 American Airlines (June 2013 transfer bonus) 1 RBC = 1.5 British Airways Avios (Spring 2013 transfer bonus) |

The RBC Infinite Avion is my personal favorite card for earning airline miles in Canada. For people who spend a lot on travel, this is a great card. Travel purchases earn extra points.

There is a travel redemption schedule for those who want to redeem their RBC points against a revenue ticket, but the greatest value in this card is in it’s ability to transfer points to the American Airlines AAdvantage program or the British Airways Avios program.

In Randy’s case, this could be a great solution for him, if he is willing to use the miles in the most efficient way. I find that most people really don’t know how to make the best use of their miles and end up not utilizing this card to it’s best ability.

Capital One Delta Skymiles

Capital One Delta Skymiles Application Link

| Type: | Mastercard |

| Rewards: | 3 Skymiles / dollar on purchases from Delta 2 Skymile / dollar on everything else |

| Annual Fee: | $120 |

| Annual Bonus: | 10,000 Skymiles (if $25,000 spent) |

| Sign-up Bonus: | 25,000 Skymiles |

The Capital One Delta Skymiles card is probably the best card for earning a large balance of miles in any program in Canada. For those who want to earn Skymiles, there is no easier way other than flying. This is also a Mastercard so there is wide acceptance.

As mentioned earlier, redemption of Skymiles, at the lowest cost level, is usually pretty tough to find. Randy wants 5 seats together, and that might prove tough for him. If he was looking for 2 or 3 seats and had the flexibility to take what Delta gives, I think this is the best card for him.

American Express Gold Rewards

American Express Gold Rewards Application Link

| Type: | American Express |

| Rewards: | 2 Membership Rewards / dollar on travel, gas, grocery and drugstores 1 Membership Reward / dollar on everything else |

| Annual Fee: | $150 |

| Sign-up Bonus: | 15,000 Membership Rewards & First year fee free |

| Point Value: | 1 Membership Reward = $0.01 towards travel 1 Membership Reward = 1 Aeroplan mile 1 Membership Reward = 1 Delta Skymile 2 Membership Rewards = 1 Starwood point |

The American Express Gold Rewards card is another great card. A lot of purchases will be in the bonus categories of travel, gas and groceries, which will earn 2 Membership Rewards, instead of just 1. These can be transferred to Aeroplan or Delta (or other programs at less favorable rates). If Randy wants to earn Aeroplan miles, I would say this is the best way he can do that through spending. This card does give Randy some flexibility to choose Aeroplan or Delta later on, should one option have more availability than the other.

American Express Starwood

American Express Starwood Application Link

| Type: | American Express |

| Rewards: | 1 Membership Reward / dollar on everything |

| Annual Fee: | $120 |

| Sign-up Bonus: | 10,000 Starwood points |

| Point Value: | 20,000 Starwood points = 25,000 Frequent Flier Miles (Aeroplan, Delta, American, US Airways) |

The American Express Starwood is a great card if you are looking to earn flexible points that can be transferred to various programs. This is the only card that can earn US Airways miles in Canada.

In Randy’s case, this could be a legitimate card to look at if he wants to try to get in on the US Airways off-peak awards to Europe. Personally, I wouldn’t take the chance on those ones, and there would be better ways to earn the miles for other programs.

Recap

There are a few different cards that can get Randy the points that he wants based on his spending.

Since he wants to redeem his points for a 5 person trip, I recommended that he go with a 2 card solution consisting of the Scotiabank Gold American Express card and the Capital One Aspire World Mastercard. He can put all his earning gas, grocery and restaurant spending on the Scotiabank Gold American Express, where he will receive 4% towards his trip, and everything else on the Capital One card, where he will earn 2% towards his trip. Based on my assumptions of his spending, he would need about $137,500 of spending to get his family of 5 to Europe.

If he wanted to redeem his points for a trip for 2, or possibly 3, there would be a larger chance he could get the seats on an award flight. In this situation, I would suggest he go with the Capital One Delta Skymiles card. He would earn a nice signup bonus, spending bonuses and 2 Delta Skymiles for every dollar he spends. Based on my assumptions, he would need about $132,500 of spending to get his family of 5 to Europe.

Aeroplan, Credit Cards