This article is an example of how I went on a Canadian credit card application spree in December 2013. There are 3 parts to this series on applying for several credit cards for sign-up bonuses

- Overview – Taking Advantage of The Best Credit Card Sign-Up Bonuses & Offers

- Specific Instructions – Maximize Rewards With A Credit Card Application Spree

- My Example – I earned $1500 Doing a Credit Card Application Spree

The Skinny

There are a lot of credit cards in the marketplace that have large signup bonuses through rewards after first purchase, promotional rates or other benefits. You will want to apply to multiple cards in one application spree (App-O-Rama).

- Large rewards as sign-up bonuses are the current best value for those looking to apply

- Canadians should aim for at least $200 in value as a sign-up bonus

- American should aim for about $350 – $400 in value as a sign-up bonus

Your credit score is the biggest determinant in whether you can do this.

- Your score will drop slightly with each application

- It will recover and improve to a higher level if you don’t run up large bill with your new credit

Factors that will make a card a good choice to apply for in an App-O-Rama

- High sign-up bonus

- First year fee either waived or offset by the rewards being earned

- Low minimum spending requirement

Definitions

App-O-Rama – the strategy of applying to multiple credit cards in a relatively short period of time.

Churn – To apply for a card, in anticipation of getting new member bonuses, even though you have already had the card before and closed it.

Spending Requirement – The minimum amount of spending required on a credit card before a sign-up bonus is paid out

Sock-drawering – To discontinue using a card once the sign-up bonus has been paid..

Introduction

Many credit cards come with various benefits for new members. Sometimes there are very large sign up bonuses, a first year annual fee waived or a 0% initial interest rate among other potential benefits.

In this article, I will talk about how to put together a great App-O-Rama (or credit card application spree) to acquire the most value from new member sign-up bonuses and other potential benefits.

In 2012, I personally earned well over $5000 in value just from credit card sign-up bonuses. The ability to make relatively large amounts of money is there.

What is an App-O-Rama / AOR?

The term App-O-Rama is the term that people on many finance related boards use to refer to multiple credit card applications in a short period of time. The whole reason to apply to many credit cards at once is to take advantage of the sign-up bonuses on each of these cards.

History

Origins – 0% Interest Rates

Not very much in Canada, but on a large scale in the United States in the early part of the 2000s, many credit cards came with some great 0% balance transfer offers for the first 12 months or 15 months of card membership. The thinking here is that people would borrow a lot of money, spend it and then pay higher interest rates on that borrowed money after the first year was up.

To take advantage of this, financially savvy people would apply for multiple cards to get as much credit as possible and borrow large sums of money against these credit cards at 0% interest. They would then put this money into a high-interest savings account and could get a return of 6% using the bank’s money.

This was great while interest rates were at 5%, however, in the latter part of the decade, interest rates dropped and thus the return for the amount of headache and risk simply made this not a very good use of time.

The Current Environment

The current credit card sign-up bonus environment is all about showering the best customers with a whole slew of rewards after the first purchase or after spending a relatively small amount of money. The thinking on the part of the credit card companies is that new cardmembers will use this card for the first few purchases, in an effort to chase that sign up bonus. Once this card is in the customer’s wallet then that customer will continue to use it.

Exploiting this, financial savvy people can apply for multiple cards with the best sign-up bonuses. Each card can be used until the minimum spending requirements are achieved and the bonus has been paid. After that the card can figuratively be “put in the sock-drawer” and no longer be used.

Canada vs US

In the current credit card environment, the United States has much more competition than Canada. As a result, the opportunities to take advantage of this are just bigger in the US.

First off, there are simply more cards and banks in the US to choose from. As a result you have less worry of running out of great offers like you might in Canada.

Secondly, the sign-up bonuses are just bigger in the US. In general, I would say that any credit card application in the US would have to net me at least $300 worth of rewards for me to apply for it. The standard seems to be 50K points (airline miles, cash rewards etc.). In Canada, the standard seems to be closer to the value of 2.5x annual fees for the gold / infinite level cards ($90 – $120 annual fees), and closer to 1x the annual fees for the very expensive platinum level cards ($400+ annual fees).

Some examples of sign-up bonuses in Canada would be:

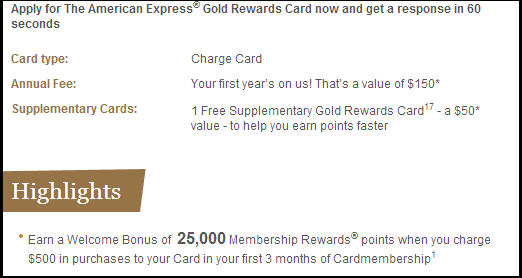

- American Express Gold Rewards Card (Canada) – 25K Membership Rewards (worth close to $300 – $400) + first year fee waived

- BMO World Elite – 30K points ($300 towards travel) + first year fee waived

- Capital One Delta Skymiles – 25K Delta Skymiles

Some examples of sign-up bonuses in the US would be:

- American Express Gold Rewards Card (USA) – 50K Membership Rewards (worth close to $800)

- Chase Hyatt Card – 2 free nights at any Hyatt in the world (can be worth $1000 each)

- Barclay’s Arrival Card – 40K points (worth $400 – $440 towards travel) + first year fee waived

Credit Scores

The biggest factor in determining whether or not you will actually be approved for these cards is your credit score.

If you have a good credit score then you can get approved for more cards. The worse your score is, the less card approvals, and less benefits you will gain.

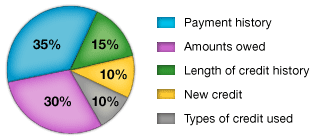

Something to be aware of is that your credit score is a function of a few different things:

- Total available credit

- Utilization of credit

- New Credit

- Average age of credit history

- Payment history

- Type of Credit used

- Recent inquiries

When you go on an application spree, your total available credit will go up, and theoretically, your utilization (in terms of dollars) will remain the same. Since the main concern is the % of your available credit that is being used, your rate of utilization will actually go down, thus increasing your score.

What will be negatively impacted is your Average age of credit history. As your apply for a lot of new credit, you will have more new credit relative to your old credit. This will negatively impact your credit score.

Something else to be aware of is that every time you apply for new credit, a hard inquiry is placed against your profile. Each inquiry will temporarily decrease your credit score slightly. After a few months, however, your score will more than recover due to the positive impacts of the lower utilization rates.

Since you are going to be benefiting by taking a temporary hit to your credit score, I think of this as “renting out” your good credit. Milenomics has a great writeup on how you this is the Monetization of Your Credit Score (in the US).

Benefits

So there a few benefits of doing an App-O-Rama. I touched on the main motivations but there can also be a lot of periphery benefits of having a lot more cards at your disposal than you might need.

Some of the benefits include:

Generating free money / rewards through the sign-up bonuses

In the current environment, this is the main motivation for doing an application spree. In Canada, I set my threshold at about $250 of value gain before I will apply for a card.

Increasing your credit score

Your credit score is a key factor in this. One of the main determinants of your credit score is the amount of credit that has been extended to you vs the amount of credit you are using. When you apply for a credit card, you are going to be extended more credit

Save money on credit card annual fees by always being in the first year when the fee is waived

If you like carrying a higher level gold / infinite type of card that normally comes with an annual fee, you can reduce your annual fees by applying for new cards every year. In the first year, while the fee is waived, use card A. Then on month 11, just before the fee is due, apply for card B, who will waive the annual fee in its first year. Once approved, cancel card A, while retaining various benefits that you value.

Gaining access to many more lucrative offers

Often credit card companies will send out very lucrative offers to cardmembers who haven’t used their cards in a while. As you have a lot of cards that are sitting idle, you might see these companies offer you various promotions.

I have received promotions from “sock-drawered” cards such as “spend $100 and receive a $25 statement credit” or “receive a $400 statement credit for spending $1000 / month for 3 months”.

Reinvesting 0% interest money at higher rates and exploiting monthly float

I alluded to this earlier, however, some cards still come with 0% balance transfer offers. If you are in need of short term cash flow, this is a decent way to get it for a short period of time.

If you are organized, then something that can be done once you have a lot of credit cards is time your purchases to the appropriate card to extend the monthly float.

Drawbacks

Doing an App-O-Rama is very much an organizational exercise. If you are disorganized, you can definitely screw this up. If you are doing this for sign-up bonuses only, it is a bit easier, but if you are looking to play the 0% game, then the cost for disorganization can be devastating and can easily wipe out all your profits and then some.

When you set this up, you will want to be organized about how much you have spent on each card and what your minimum spending requirement is on each card. If you are playing the 0% game, then you will want to make sure that you are paying the minimums and following, to the letter, all the requirements of the offer. I find it much easier, from an organizational perspective to just sign-up for cards that have good rewards bonuses for first few purchases so I have been sticking to those.

Another thing to be cautious of is that you have to manage your credit profile. Earlier, I mentioned that your credit score drops slightly with every credit card application, but soon recovers and comes back stronger as long as you do this properly. If you are going to be applying for a mortgage or other type of credit, you will want to make sure that you don’t have too many credit applications in the recent past.

Good candidates for a credit card spree

Finally, I want to talk about what makes a card a good candidate to go into your App-O-Rama. The key things to look at are the balance between the upfront rewards vs the annual fee in the first year. Balance that with the minimum spending requirement.

Let’s look at an example of 2 cards that are available in Canada right now.

| BMO World Elite | Amex Premier Gold | CIBC Aerogold Infinite | |

|---|---|---|---|

| Sign-Up Bonus | $300 toward travel | 25K Membership Rewards | 15K Aeroplan Miles |

| First Year Fee | $0 | $0 | $120 |

| Minimum Spending | First Purchase | $500 Spent | First Purchase |

| Additional Benefits | 4 lounge passes | ||

| Card Review | Excellent Card | Average Card | Weak Card |

In this case, applying for the BMO World Elite will give you $300 toward travel and 4 lounge passes in the first year. This will have a cost of putting 1 purchase on this card. The card is also a great card independent of all that, given its ~2% return on all spending. See my review here.

The CIBC Aerogold card is a really poor candidate for the application spree. You would be paying $120 in your first year as an annual fee, and you would only receive 15K Aeroplan miles after your first purchase. On top of that, unless you can really get great value from Aeroplan miles (which most people can’t), the card is a relatively weak card for most people. Applying for this card with this offer would amount to buying 15K Aeroplan miles for $120, or 1.25 cents each. This is right around the value I place on Aeroplan miles. In my opinion, being able to buy something at its fair market value is not something I would go out of my way for.

Summary

There are a lot of credit cards in the marketplace that have large signup bonuses through rewards after first purchase, promotional rates or other benefits. You will want to apply to multiple cards in one application spree (App-O-Rama).

- Large rewards as sign-up bonuses are the current best value for those looking to apply

- Canadians should aim for at least $200 in value as a sign-up bonus

- American should aim for about $350 – $400 in value as a sign-up bonus

Your credit score is the biggest determinant in whether you can do this.

- Your score will drop slightly with each application

- It will recover and improve to a higher level if you don’t run up large bill with your new credit

Factors that will make a card a good choice to apply for in an App-O-Rama

- High sign-up bonus

- First year fee either waived or offset by the rewards being earned

- Low minimum spending requirement

Credit Cards

Hmm for the CIBC aerogold

“Applying for this card with this offer would amount to buying 15K Aeroplan miles for $120, or 1.25 cents each.”

I don’t think the math is right… it’s actually 0.8cents each…

Hi, I have just come across your website, so before I ask some questions, are you still into Credit Card Churning, or App-o-rama ?

thanks, Susan

Hi Susan,

I last did an app-o-rama in December 2013, but I am workign on one right now. Putting together a list of cards that I will be applying for and will write that one up.

Please go ahead and ask away and Ill do my best to answer.

thanks again for that. So, if you don’t mind, how many cards is your goal on a app-o-rama? Will you cancel all within the year, or how many will you keep? Do you apply all around the same time, within days, for credit score reasons, or? Are you planning on doing this on a more yearly, or 6 mth bases like some do in the USA? I just received 2 each for my husband and I. It did lower our score by about 30 points each, I assume thats a hard hit, and whatever else makes it drop. Now, do you know how long it takes for it to rise back up, as I thought it is a temporary lower score ? I find calling equifax, etc and ask these questions they are so vague on scores, etc. FYI, we do not use them, they were strictly for the bonus. thanks again !!

The terms and conditions of Amex says the points will be erased if you cancel your card…

You would have to use all points before the end of the first year.

Is there a way around this?

To keep Memberhsip Rewards, you need an active card with AMerican Express that can be tied to it.

You can close the Amex Gold (for exmaple) but if you do not have another card (say Amex PLatinum) then there will be no card attached the Memberhsip SRewars acoutn adn the accont will close.

So the solution is to sign up for a different card that has Membership Rewards, say Amex Business Gold (also free in first year) and you should be good until you are ready to close that one.

What I would do is transfer them to the frequent flyer program of your choise (ie aeroplan or ba avios) while you are still an amex gold card member. That is what you intended on using them for, right? The travel pay back option requires an Amex card to be open for the charge anyways.

I hope that helps.