This article is an example of how I went on a Canadian credit card application spree in December 2013. There are 3 parts to this series on applying for several credit cards for sign-up bonuses

- Overview – Taking Advantage of The Best Credit Card Sign-Up Bonuses & Offers

- Specific Instructions – Maximize Rewards With A Credit Card Application Spree

- My Example – I earned $1500 Doing a Credit Card Application Spree

The Skinny

If you are interested in applying for several credit cards to accrue many sign-up bonuses, this is a guide for the things you should do to prepare for your application spree (or App-O-Rama). Your ability to get approved for credit products will be directly related to your credit score.

- Time your App-O-Rama such that it is not too soon after you have just applied for a lot of credit and not too soon before you will be applying for a lot of credit, such as a mortgage

- Check your credit score before you start your App-O-Rama

Organization

- Have a system in place for monitoring how much you have spent on each card, and what the minimum spending requirements are for each plan

- Create reminders to follow up if your rewards don’t show up

Making a card list

The most important thing is creating a card application list.

- Select your cards based on the right balance of sign-up bonus, first year fee and minimum spending requirements

- Give preference to cards that you also actually want to hold due to better rewards

- Can you actually use the rewards relatively immediately?

- Limit yourself to 1 or 2 cards from each issuer

Handling rejection

- If your application gets rejected, call the reconsideration line to plead your case

- Offer to close other cards or move credit line from other cards in an effort to get the new one

Introduction

There are only 3 reasons you should apply for a credit card:

- Great rewards for regular spending

- Great perks for card holders such as lounge benefits and insurance

- Great sign-up bonuses

This series talks about how to go on an application spree (App-O-Rama) to accrue a whole lot of great sign-up bonuses in one shot.

Preparation

In the previous article in this series I talked about the credit score. Since we are focusing on credit cards here, your credit score is going to be the most important thing in determining how profitable your application spree is going to be.

Timing your Spree

The first thing will be timing. In the previous article, I commented on how the inquiries on your credit report from each application will likely temporarily reduce your score. Your score will likely recover and potentially be better after a few months.

Do it a few months after you have applied for other credit

First, you will want to make sure that your credit score is at its highest prior to starting your application spree. It is probably a good idea to wait a few months after you have recently applied for credit before you apply for a whole host of cards. Remember, one of the key reasons for doing this in a single shot is that you want to make sure that each of the applications looks at your credit score while it is at its highest.

Do it several months before you will need to apply for other credit

Another implication of this timing is that you are going to want to make sure that you don’t have any upcoming credit applications soon after your App-O-Rama. If you are expecting to be putting in a mortgage application or buying insurance a month or 2 after your App-O-Rama, you would be better off waiting.

Checking your credit score

Given that your credit score is such an integral part of this, you will want to make sure to check what is in your credit file and monitor it. There are 2 credit reporting agencies in Canada and each of them are required to send you your report by mail. Here are the instructions:

- Equifax Canada – Get your free credit report here

- Transunion Canada – Get your free credit report here

If you find an error (statisticians say there are errors in between 10% and 33% of all credit reports), you can dispute it. You can file a dispute online if you find an issue. Dispute forms are available for Equifax and Transunion.

What is a good score?

You will get a credit score in the range of 400 – 900. Most people are probably in the 600+ range. If you have over 750, you are likely going to get any card you apply for. The Globe and Mail did a discussion on this here.

Organization

Once you have set yourself up for your application spree, you need to make sure that you are ready for the organizational exercise that is an App-O-Rama.

Get your financial affairs in order

Primarily, you need to make sure you have your financial affairs in order. You will want to make sure you already have some sort of system for monitoring your inflow and outflow in your credit cards and bank accounts. This is really just to make sure that you are not complicating an already messy financial life (i.e. if you can’t manage 2 credit cards you are better off not trying to manage 5). This should really be the system you normally have for monitoring how much you owe. If you can answer me how much your last payment was and how much is outstanding on each of your credit cards (as you should be able to) then you should have this covered.

Have a plan for your upcoming spending

If you are applying to a bunch of credit cards for their sign-up benefits, you are likely going to have to have some sort of minimum spending requirement on each of the cards. Some cards will require you to spend $1000 in 3 months to get your bonus. Others will give it to you after your first purchase. You will want to have a plan for how to get all of those minimum spending requirements in the appropriate time frame.

Suggested system

I suggest having a system where you simply make the next card in the sequence your “everything card” until the spending requirement has been reached. I also suggest you go from smallest to largest spending requirement. Let’s look at an example. Let’s say that I have 5 cards, and they have the following spending requirements:

| Card | Minimum Spending Requirement | Time Frame |

|---|---|---|

| Scotia | $500 | 4 months |

| American Express | $1000 | 3 months |

| RBC | First Purchase | 6 months |

| TD | $3000 | 3 months |

| Capital One | First Purchase | 6 months |

I would attack this from smallest to largest spending requirement. The RBC and Capital One cards would be easily taken care of with small first purchases (I would make sure these are SMALL purchases). Given that both the $1000 to American Express and $3000 to TD need to be done in 3 months, I would put all spending on the American Express first. Once I hit the $1000 in spending there, I would put all spending on the TD. Hopefully I could reach the minimum required in the 3 months. I would wait on the Scotia, because I still have month 4 that could be dedicated to the Scotia card. Here are a few suggestions on how to get your spending requirements taken care of (moving your spending forward):

- Prepay your utility bills

- Buy gift cards for stores you usually shop at

- Buy prepaid mastercard and Visa cards (note you will need to pay the fee)

- Pay for group events on your credit card and get your friends to pay you back in cash

Million Mile Secrets has a list of 40 ways to complete your spending requirements. Most are applicable to Canadians.

Follow Up System

Something else to be aware of is managing when you expect your bonus to be paid out. You will want to have some sort of a system for making sure you actually get your bonus paid out. I think a simple Google Calendar entry for a week after your bonus should be paid out should suffice as a reminder to check on it. It would be a terrible thing to go to all this effort if you didn’t actually get the bonus because it got lost in the system somehow.

Making Your Card List

Once you are organized, you are going to want to make the list of cards you want to apply for. In the previous article, I commented on the things to look out for, and what makes a great candidate for an App-O-Rama. In Canada, we don’t have as many choices of cards, so your work is a little bit easier. In the US, since there are so many cards to choose from, you are going to want to consider your cash / mileage balances much more. Milenomics does a great job discussing it here. There are a few things to bear in mind when comparing cards:

- Is this actually a useful card to carry?

- Upfront rewards vs first year annual fee

- How easily can you extract value from the upfront rewards

- Do you get 5K points bonus, but need 15K points to redeem?

- Minimum spending requirements

- Limiting the number of cards from any one institution (I suggest 1 card per institution)

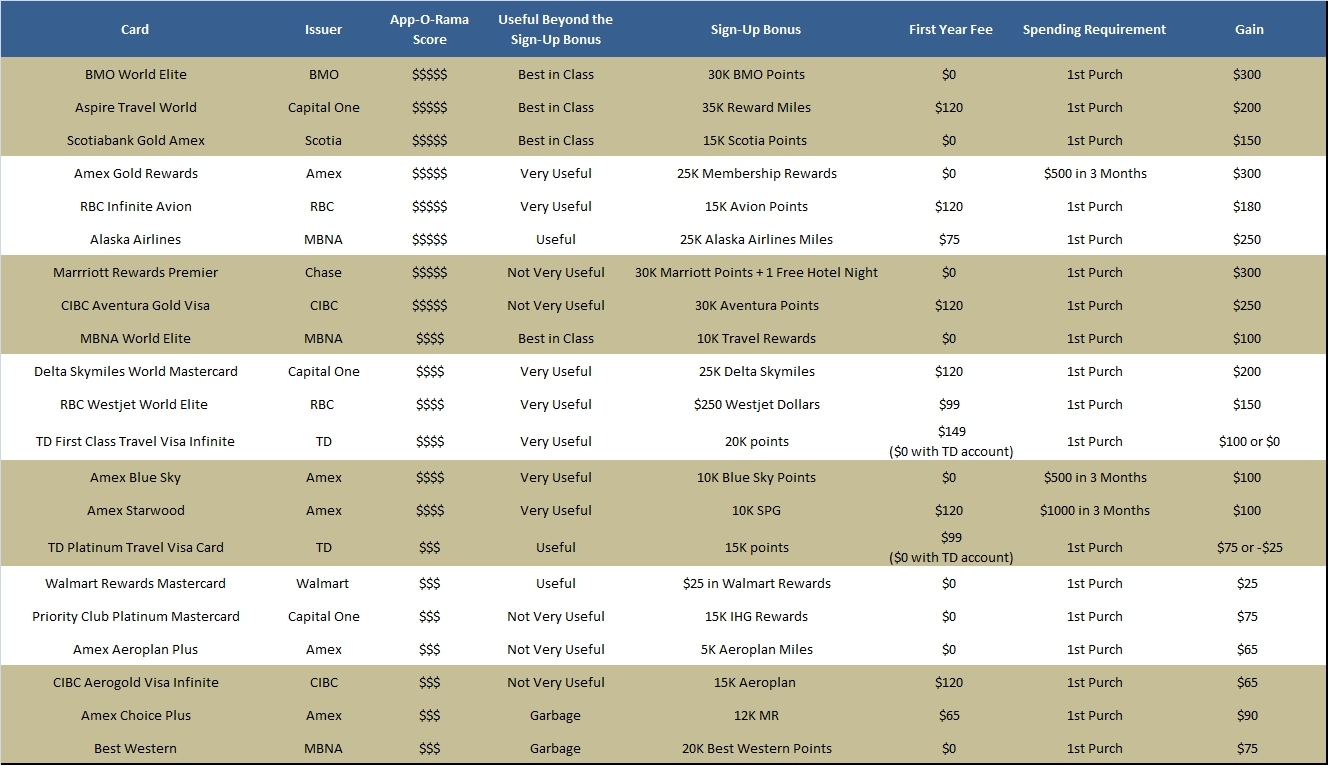

For each card, I give a subjective App-O-Rama “score” which puts these pieces into a numerical value, then apply for the best one from each issuer. In December 2013, here is my list of cards that I would be interested in putting in my App-O-Rama. See the image below the table for more details, including the first year annual fee and the usefulness of each card.

| Card | App-O-Rama Score | Sign-Up Bonus |

|---|---|---|

| BMO World Elite | $$$$$ | 30K BMO Points |

| Cap One Aspire Travel World | $$$$$ | 35K Reward Miles |

| Scotiabank Gold Amex | $$$$$ | 15K Scotia Points |

| Amex Gold Rewards | $$$$$ | 25K Membership Rewards |

| RBC Infinite Avion | $$$$$ | 15K RBC Avion Points |

| MBNA Alaska Airlines | $$$$$ | 25K Alaska Miles |

| Chase Marrriott Rewards | $$$$$ | 30K Marriott Points + 1 Free Hotel Night |

| CIBC Aventura Gold Visa | $$$$$ | 30K Aventura Points |

| MBNA World Elite | $$$$ | 10K MBNA Rewards |

| Cap One Delta Skymiles World | $$$$ | 25K Delta Skymies |

| RBC Westjet World Elite | $$$$ | $250 Westjet Dollars |

| TD First Class Travel Visa Infinite | $$$$ | 20K TD Points |

| Amex Blue Sky | $$$$ | 10K Blue Sky Points |

| Amex Starwood | $$$$ | 10K Starwood Points |

| TD Platinum Travel Visa Card | $$$ | 15K TD Points |

| Walmart Rewards Mastercard | $$$ | $25 Walmart Dollars |

| Cap One Priority Club Platinum | $$$ | 15K Priority Club Points |

| Amex Aeroplan Plus | $$$ | 5K Aeroplan Miles |

| Amex Choice Plus | $$$ | 12K Membership Rewards |

| MBNA Best Western | $$$ | 20K Best Western Points |

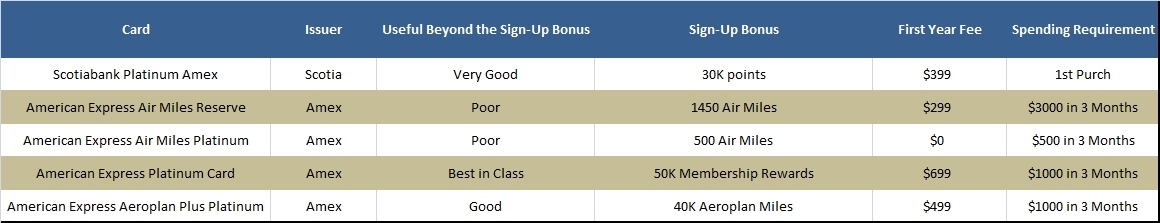

| Card | Issuer | Useful Beyond the Sign-Up Bonus | Sign-Up Bonus | First Year Fee | Spending Requirement |

|---|---|---|---|---|---|

| Scotiabank Platinum Amex | Scotia | Very Good | 30K points | $399 | 1st Purch |

| American Express Air Miles Reserve | Amex | Poor | 1450 Air Miles | $299 | $3000 in 3 Months |

| American Express Air Miles Platinum | Amex | Poor | 500 Air Miles | $0 | $500 in 3 Months |

| American Express Platinum Card | Amex | Best in Class | 50K Membership Rewards | $699 | $1000 in 3 Months |

| American Express Aeroplan Plus Platinum | Amex | Good | 40K Aeroplan Miles | $499 | $1000 in 3 Months |

Actually Applying

Now that you have your list in the right order, you will want to actually apply for the cards by clicking on the appropriate apply link below and giving them your information. As you probably know, you are likely to get a response immediately. Depending on your credit score and the cards you are applying for, you are likely to get approved for many of your cards. Now, you just have to wait for the cards to come in the mail. For some of your card applications, you might get the dreaded “we require more time to review your application” line. If this is the case, you simply have to wait until a human being reviews your application and says either yes or no. Usually you will get a response in the mail, but you can usually call the company after a week or so if you are impatient.

Handling Rejection

There are likely going to be some card applications that you are not going to get accepted for. That is the nature of the game. Some would say that if you are not getting rejected for any cards, you are not applying for enough cards. When you get rejected, you have 2 choices:

- Sit in the corner and cry about it

- Call up the card issuer and plead your case

Personally, I prefer to call up the card issuer and plead my case. When you find out that you were rejected, you are going to also be told what caused you to be rejected. You need to have some excuse to alleviate that concern. You should call up the reconsideration line, (the card application phone number referenced in your rejection letter) and plead your case. Here are some things you can offer to convince a card issuer to accept your application:

- If you have multiple cards with the card issuer, offer to close one (one that you don’t want)

- If you have multiple cards with the card issuer, offer to lower your credit line on another card, so they are not extending more credit to you

- If you already have a similar product, suggest that you have a business and want to keep your personal and business expenses on separate credit cards

I would strongly suggest that your reason for applying for the new card should not reference the sign-up bonus. Hopefully you will get approved for the card.

Follow through with your plan

Now that you have your cards, you simply have to follow through with your spending plan and monitor your inflow and outflow on each card until you get your bonus. Enjoy the free money.

Recap

If you are interested in applying for several credit cards to accrue many sign-up bonuses, this is a guide for the things you should do to prepare for your application spree (or App-O-Rama). Your ability to get approved for credit products will be directly related to your credit score.

- Time your App-O-Rama such that it is not too soon after you have just applied for a lot of credit and not too soon before you will be applying for a lot of credit, such as a mortgage

- Check your credit score before you start your App-O-Rama

Organization

- Have a system in place for monitoring how much you have spent on each card, and what the minimum spending requirements are for each plan

- Create reminders to follow up if your rewards don’t show up

Making a card list The most important thing is creating a card application list.

- Select your cards based on the right balance of sign-up bonus, first year fee and minimum spending requirements

- Give preference to cards that you also actually want to hold due to better rewards

- Limit yourself to 1 or 2 cards from each issuer

Handling rejection

- If your application gets rejected, call the reconsideration line to plead your case

- Offer to close other cards or move credit line from other cards in an effort to get the new one