This is an article in a multi part series on the different ways to earn Aeroplan miles

- Overview

- Part 1 – Credit Card Spend

- Part 2 – Flying on Star Alliance Carriers

- Part 3 – Credit Card Sign-Up Bonuses

- Part 4 – Partner Offers

The Skinny

There are many different ways to earn Aeroplan miles.

Comparing the miles you could earn vs what else you could earn instead instead can help dictate whether Aeroplan is the bestPlan for you

Using a Toronto-Calgary flight as an example reward, we can assess whether taking Aeroplan miles is best, given how much of that flight the options would give us.

Valuing Aeroplan Miles

Consider your ability to gain value from miles.

I value miles at less than 1.25 cents each

- My ability to redeem my miles (sell them back to Aeroplan) for about 1.75 cent to 2 cent each

- Inflation Risk

- the price in miles for any given redemption will go up before I can use it

- Miles (money) tied up with Aeroplan for long periods before it is redeemed

- Headaches associated with redeeming miles

- Phone hold times, inconsistency with implementation of stated rules etc.

Costs

Whenever you earn Aeroplan Miles, you are bearing costs of earning which can be:

- Real Costs

- Opportunity Costs

- Energy Costs

Pooling

Benefits of pooling exists when you combine Aeroplan miles from multiple sources:

- Small amounts earned from multiple sources will accumulate to have value

Benefits of pooling is sometimes overvalued

Overview

There are a few different ways to earn Aeroplan miles:

- Credit Card spending

- Flying on Star Alliance Carriers

- Credit Card Sign-Up Bonuses

- Partner Offers

- Buying miles directly from Aeroplan

Each time you earn an Aeroplan mile, you should ensure that you are earning the best and most valuable rewards currency for your needs.

It is also important to value your Aeroplan miles appropriately for your needs.

Opportunity Costs

The idea of opportunity costs is that whenever you take one option, you forgo the benefits of your single next best option that you didnt take.

Wikipedia says:

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone, in a situation in which a choice needs to be made between several mutually exclusive alternatives given limited resources. Assuming the best choice is made, it is the “cost” incurred by not enjoying the benefit that would be had by taking the second best choice available.[1] The New Oxford American Dictionary defines it as “the loss of potential gain from other alternatives when one alternative is chosen”. Opportunity cost is a key concept in economics, and has been described as expressing “the basic relationship between scarcity and choice“.[2] The notion of opportunity cost plays a crucial part in ensuring that scarce resources are used efficiently.[3] Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output forgone, lost time, pleasure or any other benefit that provides utility should also be considered opportunity costs. (from Wikipedia)

When it comes to Aeroplan miles, you take miles from different sources. You could take something else instead of Aeroplan miles, but both. We can consider this as “buying” the Aeorplan miles at a cost of whatever single next best option you didnt take.

- Credit card purchase that earns Aeroplan miles

- You give up the cashback or points that you would have earned with the next best card

- Miles for flying

- You give up the miles you would have earned if you credit your flight to another program

- Card Sign Up Bonuses

- You give up the ability to apply for a different card (assuming there is a limit to how many you can apply for)

- You give up simplicity in your financial life as you get more complicated

- Other promotions (ie mortgage that comes with x miles for origination)

- You give up the other mortgage rate that didn’t come with Aeroplan miles

- If the bank is offering the best terms regardless of Aeroplan miles, then you have no opportunity costs and the miles are free

- Buying miles

- You give up the money (explicit) that you are paying for the miles

- Buying miles at a rate of $0.03 + HST for each mile

Example: Toronto to Calgary

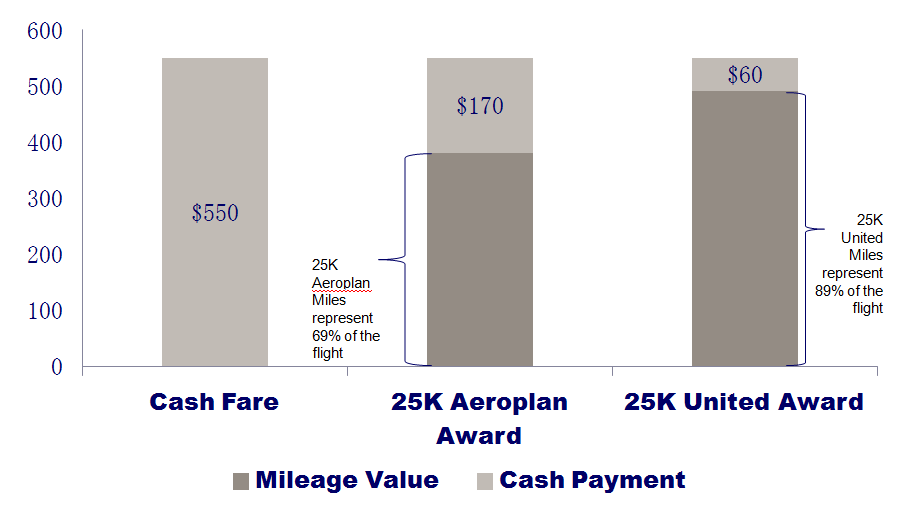

In the attached infographic, we have used the example of a Toronto – Calgary economy flight as the desired reward. This is a cross country, relatively well traveled, domestic route. While each specific flight will have its own analysis, this is a reasonable route that represents a reward that most Canadians can identify with.

From my analysis, it appears that the going rate for a revenue ticket is $550 roundtrip.

If we were to use Aeroplan miles, it would cost 25K Aeroplan miles + $170 in taxes and fees. If we were to use United miles (which we can use to book this same flight), it would cost only 25K United miles + $60 in taxes in fees.

Using the $550 as the cash fare and the rates of taxes and fees, we can see the value of the Aeroplan and United miles for this specific redemption. This will aide in our analysis of value going forward.

| Method of Payment | Rate | Value |

|---|---|---|

| Cash (Revenue Ticket) | $550 | |

| Aeroplan Miles | 25K Aeroplan Miles + $170 | 25K Aeroplan miles rep 69% of this flight |

| United Miles | 25K United Miles + $60 | 25K United miles rep 89% of this flight |

Valuing Aeroplan Miles

When valuing miles, it is always important to consider how much YOU value them at. Aeroplan miles, and any variable value points program is going to have a different value to different people.

When valuing miles for yourself, you should consider it from multiple perspectives.

- How much value will you get when you redeem them

- How much real money would you be willing to pay in real dollars today for them

My Valuation of Aeroplan Miles

Personally, I value Aeroplan miles at a rate of about 1.25 cents each. That is the maximum I would be willing to pay today for an Aeroplan mile.

This valuation comes from a combination of the following:

- Ability to redeem for at least 1.75 cents each

- I will use them at their best value for trips overseas with multiple stopovers

- My willingness to reroute my trips to reduce the taxes and fees which can be very high

- Taxes and fees reduce the value of Aeroplan miles

- Flying on different carriers can reduce the amount of taxes and fees

- See Aeroplan Taxes and Fees

- Inflation Risk

- Today, I can redeem for 1.75 cents each, but in a year, the number of miles I need might go up

- Example: today it costs 60K for a trip to Europe, but in a year it may cost 75K for the same trip

- Today, I can redeem for 1.75 cents each, but in a year, the number of miles I need might go up

- Opportunity Cost of Money

- Any time I take an Aeroplan mile, I am not keeping money in my hand

- Until I redeem that Aeroplan mile for value, I am losing the use of that capital (money not earning interest, for example)

- Difficulty in redeeming / booking my flights

- Booking a flight is easy when going through Expedia

- Booking an Aeroplan reward requires finding flights that work and more energy having to call Aeroplan etc.

Your Valuation

You would need to do your own valuation. It should be based on things that are personal to you

- The cash fares of flights you are interested in using your rewards for vs their price in Aeroplan miles

- How willing are you to reroute flights to avoid high taxes

- How quickly can you redeem your miles

- How much energy are you willing to invest to dealing with finding flights, calling Aeroplan, dealing with flights being unavailable etc.

Pooling

An advantage to having multiple ways of earning miles is that a few miles from each earning method can be combined into a single pool. I believe that this thinking is valid for specific people with the following characteristics:

- People who would be willing to pay double the economy fare for a business class seat

- Who don’t fly enough in a year to accrue significant mileage balances

- Does not take advantage of buy miles promotions throughout the year

There is definitely some value in the fact that you can earn Aeroplan miles from multiple sources. In this respect, it does make sense to take this into consideration when doing the analysis. For example, if your flying miles only amount to 500 miles per year, it would take several years to accrue enough miles to extract any value. In this case, if you already are earning Aeroplan miles from another source, those 500 miles can be added to the amount earned elsewhere and get you a reward either faster or of better value.

When the Benefits of Pooling Should not be factored into your decision

In the above example, those 500 Aeroplan miles (I value at $6.25) wouldn’t influence someone to fly Air Canada. It is also an insignificant amount. I wouldn’t want to pick an Aeroplan credit card that may not be right for me, just so I can get the extra 1K Aeroplan miles per year. I might give up much more by using the wrong credit card, in an effort to get value out of 500 Aeroplan miles.

Conclusion

There are many things to consider when you look at earning Aeroplan miles. First, you should look at the other options you have when you earn miles. The rest of this series will discuss specific situations of earning miles.

For your personal situation, it is good to consider the flights you take and other factors when valuing your miles.

Using the Toronto-Calgary flight, we can guide our analysis through this series. You should look at a flight that matches what you would like to redeem your miles on.

One comment on “Is Aeroplan The Best Plan – Overview”