This is an article in a series of articles on saving money on groceries:

- Saving money on groceries – Simpler Strategies

- Saving money on groceries – Advanced Strategies

- Saving money on groceries – Example

- President’s Choice World Elite card review

The Skinny

Groceries can cost a lot, but don’t have to. Here are some of the ways to save on staples:

Simpler Strategies:

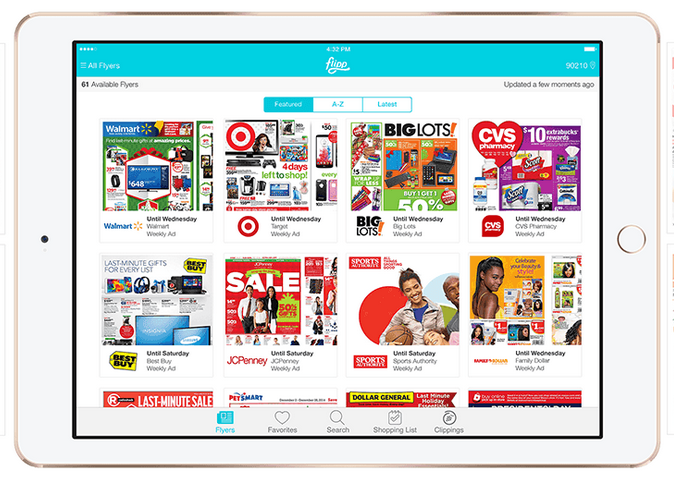

- Price-matching (made easier using the Flipp app)

- Store loyalty programs

- Using the right credit card

Advanced strategies (next article):

- Gift card gaming

- Couponing

Overview

Presidents Choice just released the PC Financial World Elite Mastercard, targeted at people interested in saving money on groceries. If you’re savvy, you can layer the different kinds of savings to ‘double-‘ and ‘triple-dip’ your discounts.

I’m not going to repeat what I call “basic personal finance”. While valuable, I won’t spend energy talking about how to make a budget, not shop on an empty stomach or buy in bulk. This article focuses on strategies that assume your shopping cycle and shopping lists are already taken care of.

Types of discounts

When looking to reduce your grocery expenses, there are 2 different ways to earn a discount:

- Front-end discount

- Reducing what you end up paying at the store

- Back-end rebates

- Getting some amount back after you have left the store

The combination of these gives rise to the idea of double-dipping and triple-dipping. If you can combine discounts, that is ideal. In general, front-end discounts usually don’t impact your back-end discounts, so a double-dip usually consists of 1 front-end and 1 back-end discount.

I’ll discuss this in an example in the other article in this series.

Stores in Toronto Area

I live in Toronto and I will discuss these in the context of the stores that are in the Toronto area. Here is a list of the stores and their price-matching policy, loyalty program and whether they accept American Express cards or not.

| Store | Parent Company | Price-Matching | Loyalty Program | Accept American Express |

|---|---|---|---|---|

| Loblaws | Loblaw Inc (President’s Choice) | No | PC Plus | No |

| Canadian Superstore | Loblaw Inc (President’s Choice) | Yes | PC Plus | No |

| No Frills | Loblaw Inc (President’s Choice) | Yes | PC Plus | No |

| Sobeys | Sobeys Inc | No | Air Miles | Yes |

| Freshco | Sobeys Inc | Yes | – | No |

| Metro | Metro Inc | No | Air Miles | Yes |

| Food Basics | Metro Inc | No | – | Yes |

| Longo’s | Longo’s | No | No | Yes |

Price-Matching

The first way that I like to save money at the grocery store is through price-matching. This is a form of a front-end discount, where I end up paying less when I actually make the purchase.

I use an app so this is a much easier process than it would otherwise be.

Price-matching Stores

Every store has their own price-matching policy. I have found that the higher end stores, such as Sobeys, Metro and Loblaws don’t do the price-matching. The “discount” stores, such as Freshco, No Frills and Walmart, tend to have price-match policies.

I shop at Real Canadian Superstore, which allows price-matching. Because of their price-match policy, I am able to pay the lowest price for each product.

Here is a list of the price-match policies in Canadian stores.

Finding the best price

If I had to plan this out in advance of going to the store, I would never do the price-matching thing. Fortunately, I have downloaded the Flipp app to my phone. From this app, I can just search for any product and it will show me the current ads in my area that have this product.

My Strategy

I usually go to the store and fill my cart with whatever I want to buy, regardless of the price at Superstore. Once I am ready to check out, I go through each item in my cart and check them in the Flipp app. If that item is cheaper at another store, I put it into the “clippings” section. When I am checking out, I simply show the lower price to the cashier and they charge me that price.

HowToSaveMoney.ca’s guide to Price Matching in Canada

Loyalty Programs

Another way to save money at the grocery store is to take advantage of the loyalty program that a store might offer. In Toronto’s stores, Air Miles is the loyalty program of Sobeys and Metro, while PC Plus is the loyalty program of the Loblaws (PC) family of stores. Loyalty programs are a form of a back-end rebate, where the store gives you a rebate for future use.

All of the stores use their loyalty programs to incentivize purchases of certain products. PC Plus uses this method exclusively. “Earn 20 PC points for every $1 spent on apples” is a common type of promotion. Sobeys and Metro are the only ones (that I am aware of) that give a certain amount of Air Miles for each dollar spent.

Air Miles

Both Sobeys brands and Metro brand stores partner with Air Miles. At both stores, the earning scheme is earn 1 Air Mile for every $20 spent in a week. While not a significant discount, it is still something.

It seems that the higher end stores offer the loyalty points, while the lower brands tend to not. Sobeys offers Air Miles, while Freshco does not. The same is true for Metro and Food Basics, respectively.

In my experience, base prices at Freshco tend to be noticeably cheaper than Sobeys, which significantly more than offset the value of any potential Air Miles earned.

PC Plus

PC Plus is the proprietary points program of the President’s Choice family of grocery stores. PC points are offered only to incentivize specific products and there is no set amount of PC points earned for general shopping. Many of my weekly trips to Real Canadian Superstore end up with me earning no PC points.

The good thing about PC points is that they can be earned at all PC stores. Unlike the Sobeys and Metro store Air Miles programs, there is no penalty for shopping at the lower brand stores.

This means there are more opportunities for a double-dip as mentioned in the Liberte yogurt example above.

Credit Cards

The easiest way to get a better rate on your grocery spending is to carry the best credit card for your grocery purchases.

American Express cards offer the best potential return, with the Scotiabank American Express Gold, my personal favourite card, offering 4% return on grocery purchases. Something to note is that this is a bonus for purchases from stores coded as grocery store purchases.

Stores such as Walmart do sell groceries, but since Walmart is usually not coded as a grocery store, it would not earn any bonus. All purchases at Walmart (grocery or otherwise) would receive the “return on other purchases” rate. (Update: Some Walmart Superstores are allegedly coded as grocery stores for Mastercards. Test these out on your local store.)

Here is a listing of the cards that offer a bonus for grocery store spending:

| Card | Type | Return at Grocery Store | Return on other purchases | Annual Fee |

|---|---|---|---|---|

| Scotiabank American Express Gold | Amex | 4% | 1% | $99 |

| Scotiabank Momentum Visa | Visa | 4% | 1% | $99 |

| MBNA Smart Cash | Mastercard | 2% | 1% | $0 |

| American Express Gold | Amex | 2 Membership Rewards | 1 Membership Reward | $125 |

| PC Financial World Elite | Mastercard | 3% at PC Stores | 1% | $0 |

| TD Aeroplan | Visa | 1.5 Aeroplan Miles | 1 Aeroplan Mile | $120 |

If you use a card that privileges spending on groceries, as the ones I have noted above, you will save more money.

Leveraging

The major advantage here is that you get this benefit on all purchases that are charged to your card from a grocery store. That does not mean you get the bonus for groceries purchased at any store. If you understand how this works, you can get creative about this and buy whatever the grocery store will sell.

I’ll talk about this further in the advanced strategies section here.

Conclusion

There are many ways to save money at the grocery store. I have discussed 3:

- Price-matching

- Loyalty programs

- Credit cards

In the next article, I’ll discuss some more advanced strategies.

3 comments on “Saving Money on Groceries – Simpler Strategies”